does td ameritrade report to irs

Ad Refine Your Retirement Strategy with Innovative Tools and Calculators. Anything else you want the.

Td Ameritrade Review A Robust Investing Platform

Individual Tax Return Form 1040 needs to be filed with the IRS by April 15 in most years.

. TD Ameritrade does not report this income to the IRS. To retrieve information from their server you will. 3 Supplemental Summary Page A snapshot of the additional information that TD.

If you have any questions please contact your Advisor or call TD Ameritrade Institutional at 800-431-3500. What does TD Ameritrade report to IRS. Have you talked to a tax professional about this.

Your email address will not be published. TD Ameritrade does not report this income to the IRS. Intraday data is delayed at least 20 minutes.

Under the My Accounts list in the left hand column click View e-Documents. The topic of this. Under the Documents listing locate your T5.

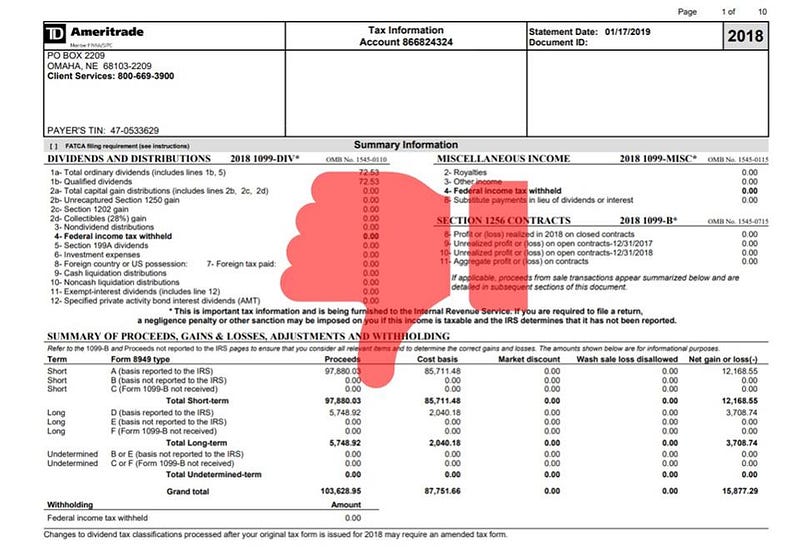

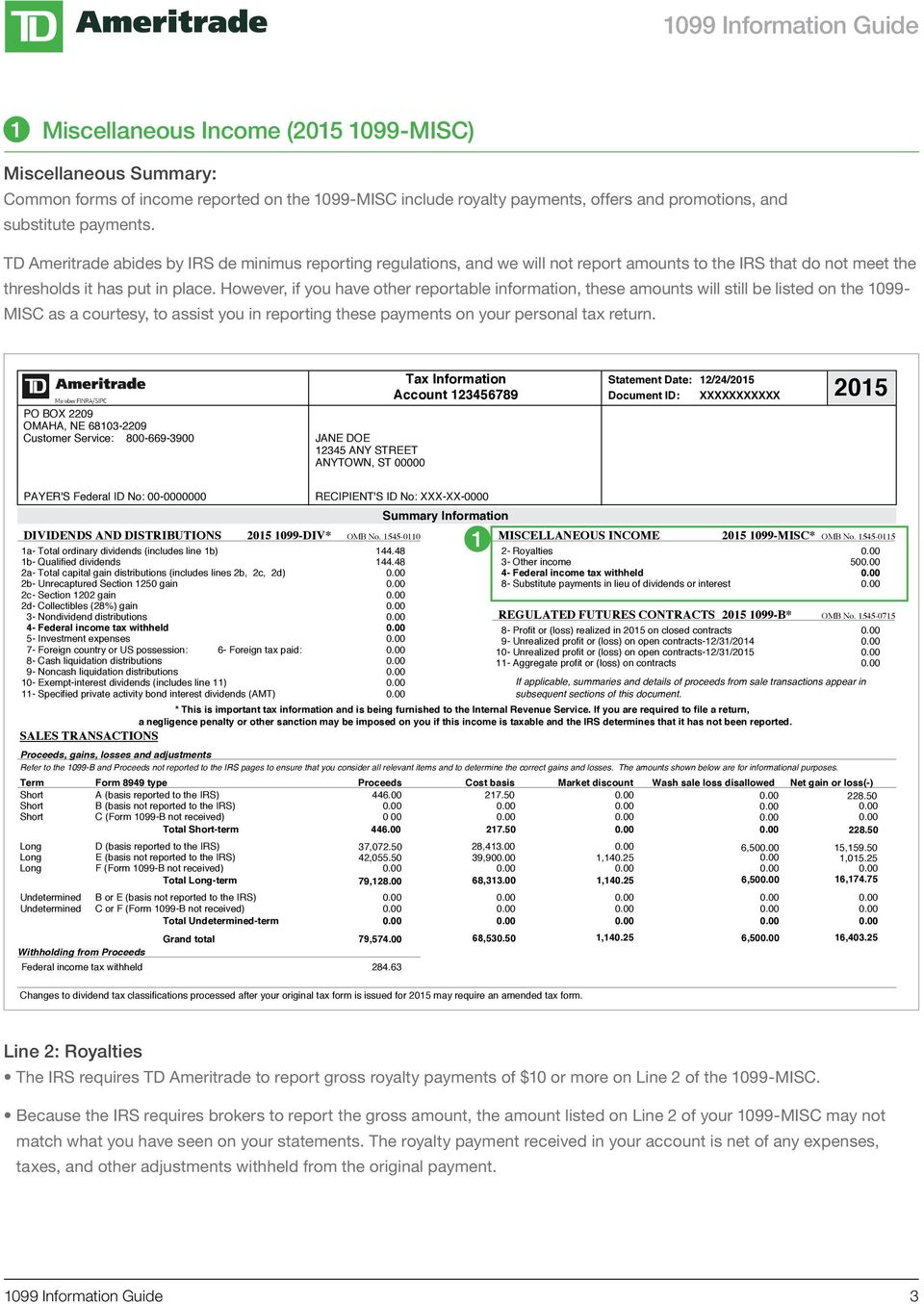

TD Ameritrade abides by IRS de minimus reporting regulations and we will not report amounts to the IRS that do not meet the thresholds it has put in place. My TD Ameritrade Tax Statement shows. YOur CONSOlIDATED 1099 FOrM This booklet accompanies your Consolidated 1099 Form for the 2009 tax year.

Steps to access your T5 through online banking. Understanding Form 1040. TD Ameritrade will not report cost basis information on tax-exempt accounts to the IRS.

Does Ameritrade report to the IRS. However if you have other. We Help Taxpayers Get Relief From IRS Back Taxes.

Required fields are marked Comment. TD Ameritrade does not report this income to the IRS. Leave a Reply Cancel reply.

Take Advantage of Potential Tax Benefits When You Open a TD Ameritrade IRA Today. Its the 1 mistake made by new traders and you may already be making it. TD Ameritrade hosts an OFX server from which your 1099-B realized gain and loss information may be retrieved by our program.

You pay tax on it if you profit income tax rate if short term capital gains. Posted on March 10 2017 by admin. Ad These options trades could help you earn no matter what the market throws at you.

If you have any questions please contact your Advisor or call TD. Have you talked to a tax professional about this. TD AMERITRADE does not report this income to the IRS.

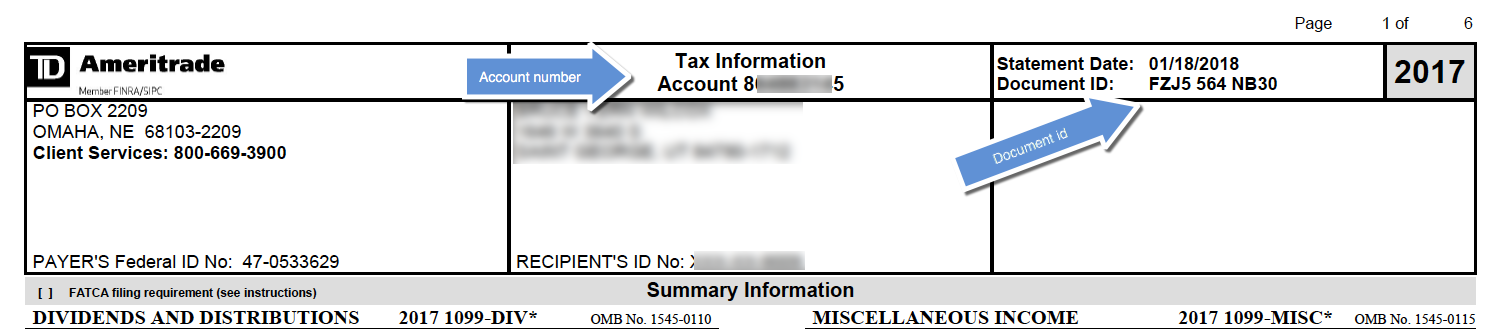

Document ID Number What does TD Ameritrade report to IRS-----The most important part of our job is creating informational content. Ad Based On Circumstances You May Already Qualify For Tax Relief.

Deciphering Form 1099 B Novel Investor

Mr Rjb Jr S Td Ameritrade Statements March 2015 06 18 2015

Td Ameritrade Says I Made 196k In 3 Months R Tax

What Are Qualified Dividends And Ordinary Dividends Ticker Tape

1040s 1099s Other Federal Tax Forms What You Mig Ticker Tape

Get Real Time Tax Document Alerts Ticker Tape

Are You Considering These 4 Things When Choosing A Crypto Tax Software Cointracker

How To Read Your Brokerage 1099 Tax Form Youtube

Td Ameritrade Says I Made 196k In 3 Months R Tax

Td Ameritrade Ofx Import Instructions

Td Ameritrade Says I Made 196k In 3 Months R Tax

1099 Information Guide Pdf Free Download

What Are Qualified Dividends And Ordinary Dividends Ticker Tape